Take advantage of portfolio margin and increase your buying power with up to 6.7 times more leverage than a standard margin account. Qualified investors that have a $125,000+ portfolio and meet our minimum requirements are able to use portfolio margin to invest more capital, potentially better weather market events, diversify their portfolio, and potentially yield greater returns. It's important to remember that with the opportunity for greater returns also comes the risk of greater losses.

Invest with TD Ameritrade and leverage so much more than buying power

Tools

Access all of our trading tools on the industry-leading thinkorswim platform.Education

Learn and grow with our educational resources, tailored to suit your unique needs.Support

Reach out for help whenever you need it, with 24/7 account support from trading specialists.

How to get started today

2. Call to request an upgrade at 877-877-0272. Select option 2 and request a portfolio margin upgrade, get more information, or ask questions. Questions and concerns can also be sent to support@thinkorswim.com.

How portfolio margin works

The goal of portfolio margin is to set margin requirements that reflect net risk, which may allow our clients to benefit from lower margin requirements and more effective use of capital. Unlike traditional margin loans, which automatically require you to fund a set percentage of the investment, it aligns requirements with your portfolio’s overall risk based on the net exposure of all positions, not just on individual ones. That often means that a well-hedged portfolio can require a much lower buy-in; however, you must maintain $100,000 net liquidating value in your account to remain eligible. Here's how maintenance requirements are calculated:

1. We create a range of theoretical price changes across your margin account: between -15% and +15% for stocks and options positions and -12% and +10% for large and small cap broad based indices.+

2. The range is divided into ten equidistant points, and the gain/loss on the entire position is calculated at each of the ten points (scenarios).

3. For options, we use two methods to dynamically incorporate implied volatility (IV) into the risk array (sticky strike vs. sticky delta).

4. Finally, we calculate your greatest possible loss on each scenario, which becomes your margin requirement.

+Wider stress parameters that result in a larger margin requirement may be enforced at any time.

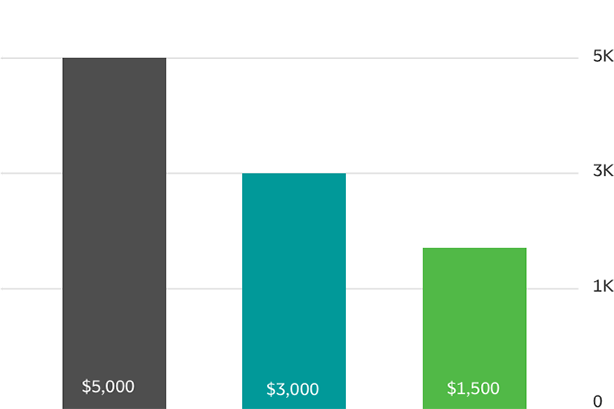

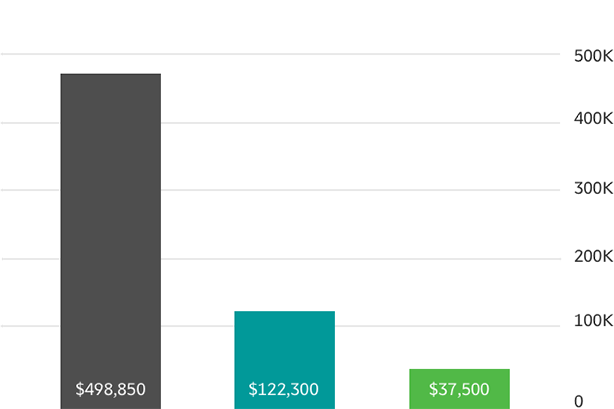

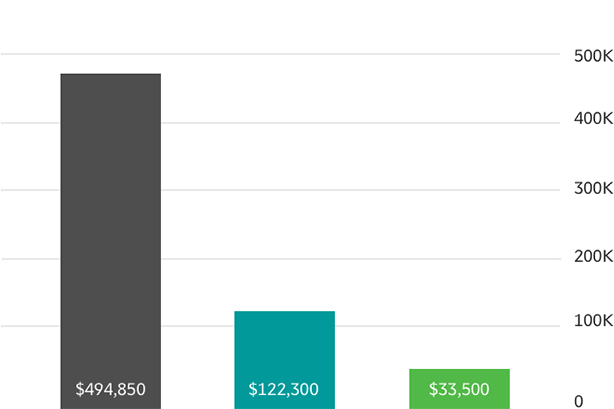

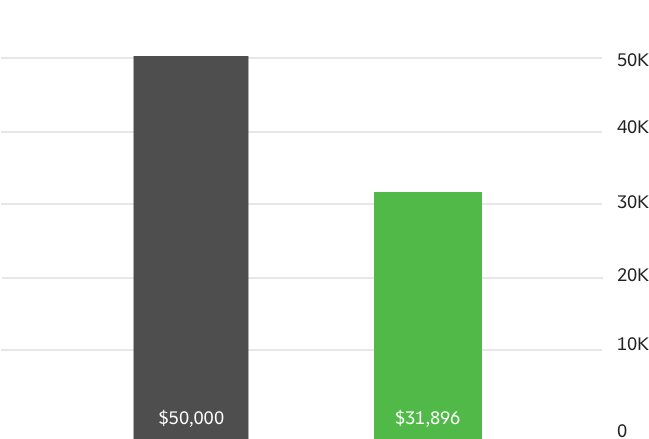

How added leverage can enhance your strategy

Key considerations

Portfolio margin can be a great resource for people who want more investing flexibility. Before you get started, keep these details in mind.

- Portfolio Margining is not suitable for all investors and is greater risk than cash accounts

- If you want to minimize risk, consider diversifying your portfolio and aligning margin requirements on the net exposure of all your positions, not just one of them.

- If your account falls under $100,000 Net Liquidating Value and you do not bring it above this watermark, you will be removed from the portfolio margining system.

- The requirements for portfolio margin are: a minimum of $125,000 account equity (you cannot combine accounts to reach this), full options trading approval, and three years of experience trading options.

- Portfolio margin is only available to margin (non-IRA) accounts.

See the process—and results—firsthand

Smart traders never stop learning

Big margin for the masses: the nuts and bolts of portfolio margin

Portfolio margin: how it works and what you need to know

Got leverage? Portfolio margin versus Regulation T margin

Capiche: leverage into a margin world

Capiche? Portfolio margin part 2: greeks, unveiled

Capiche? Portfolio margin part 3: profit, loss, and expiration