Get in touch Call or visit a branch

Commission-free online trading

Tax-loss Harvesting

Understanding tax-loss harvesting

Take advantage of dips in the market with tax-loss harvesting. This complimentary service for Essential* and Selective* Portfolios will analyze your portfolio daily, searching for opportunities to initiate tax-loss harvesting. When such an opportunity arises, TD Ameritrade Investment Management will sell the position for you.

Essential Portfolios* and Selective Portfolios* are offered through TD Ameritrade Investment Management, LLC ("TDAIM"), but they are no longer accepting new investors. The tax-loss harvesting feature is only available to current investors with the TDAIM ETF-based portfolios in taxable TD Ameritrade Investing Accounts.

Introduction to tax-loss harvesting

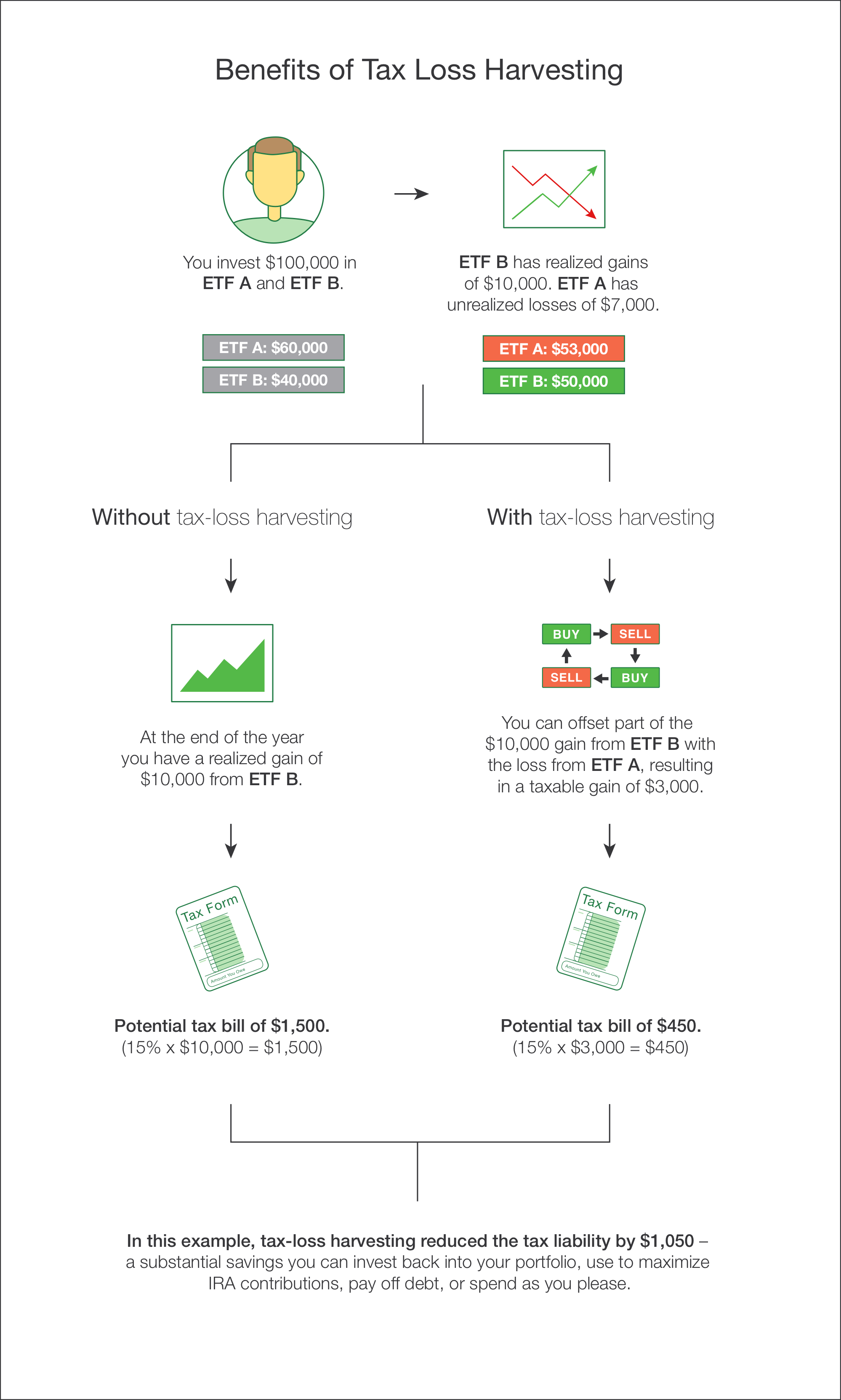

Stated simply, tax-loss harvesting means selling an investment that has lost value and purchasing another security to replace it. Then, the investment loss can potentially be used to reduce the taxes you pay on investment gains you might have, or to reduce your other taxable income, allowing greater potential benefit to you.

Traditionally, tax-loss harvesting has only been available to sophisticated investors managing their own portfolios or to high-priced financial advisors with wealthy clients. TDAIM makes this complex strategy available at no extra cost to all of our clients with taxable accounts in our Essential, Selective, and Personalized Portfolios* invested in ETFs.

How can tax-loss harvesting potentially benefit you?

When you file income taxes, you can use any realized capital losses to offset any realized capital gains you might have taken during the tax year, minimizing the tax liability associated with those capital gains.

If you don’t have any capital gains or if you have more losses than gains, you can use the losses to offset up to $3,000 of other taxable income per year under current tax laws, helping you to lower your tax liability in the future. Included below is a description of how tax-loss harvesting might benefit you.

Is tax-loss harvesting right for you?

While tax-loss harvesting can be helpful to many investors, it’s important to understand the situations that can make you a good candidate. Below, we’ve outlined a few typical situations to help you better understand the strategy. Tax-loss harvesting is not appropriate for all investors, and as with all tax-related questions, we encourage you to speak with your tax advisor to review your specific tax situation.

You can potentially benefit from a tax-loss harvesting strategy if:

You have significant capital gains: The benefit of tax-loss harvesting is the ability to realize losses in your portfolio and then offset any realized capital gains you take across all your investments. For example, tax-loss harvesting can be helpful in a tax year when you plan to sell an investment property, business, or other investment where you might have a large capital gain. When you enroll in our tax-loss harvesting service, TDAIM reviews your portfolio daily to look for tax-loss harvesting opportunities, which means you can realize losses throughout the year that might not necessarily be available at year-end. This may further help you to offset capital gains.

You’re in a higher tax bracket: Tax-loss harvesting may help reduce the potential income tax you have to pay. If you are currently in a higher tax bracket, you can use realized capital losses for three purposes:

1. Offset realized capital gains: higher income earners can currently pay up to a 23.8% tax rate on realized long-term capital gains. When you use tax-loss harvesting, you can use realized capital losses to reduce your total amount of realized capital gains, which would lower your tax bill.

2. Offset taxable income: If you don’t have capital gains in any given year, you can still benefit by using your realized capital losses to reduce your taxable income by up to $3,000 per year.

3. Carry over losses to future years: After using your losses to offset capital gains and income, you can use any remaining losses to offset gains or income in later years.

You want to leave investments as a legacy: If you plan to distribute your investments to heirs or charities, tax-loss harvesting may help you lower your tax bill especially when donating highly appreciated investments.

You may not benefit from tax-loss harvesting if:

You’re in a low tax bracket: Some taxpayers currently pay a 0% tax on long-term capital gains and would not benefit from tax-loss harvesting.

You plan to make withdrawals and/or portfolio changes: Essential, Selective, and Personalized ETF Portfolios are designed for long-term investors. If you already have plans to make withdrawals from your portfolio or to change your personal risk preference in the near future, tax-loss harvesting may not be the right fit.

You invest in identical investments in different accounts: You may run the risk of violating the wash sale rule if you or your spouse hold the same investments in another brokerage account that you hold in your eligible TDAIM portfolio and you regularly trade these investments. As a part of our tax-loss harvesting service, for Essential and Selective Portfolios, we only review our managed ETF portfolios and we do not review any of your other accounts at TD Ameritrade or elsewhere.

You’re invested in a retirement account: If you are only investing in a tax-deferred account, like an IRA or a 401(k), a tax-loss harvesting strategy is not appropriate for you since your investment earnings, dividends, and interest are already tax-deferred.

The TD Ameritrade Investment Management Solution

Eligible accounts

The TDAIM tax-loss harvesting service is available only for taxable account types. Taxable accounts are those on which you pay taxes on any dividends, interest, and realized investment earnings each year. Taxable accounts include individual, joint tenants with rights of survivorship, and joint tenants in common, among others.

Account types that many investors use for retirement investing are not eligible for our tax-loss harvesting service. Examples include IRAs, Roth IRAs, and 401(k)s. In these accounts, you don’t pay any taxes on dividends, interest, or investment earnings each year; therefore, using a tax-loss harvesting strategy in these account types would not provide any benefit to you.

At this time, our tax-loss harvesting service is only available in our ETF-based portfolios.

Account funding minimum

You're eligible to enroll in tax-loss harvesting regardless of account size for Essential or Selective ETF Portfolios in taxable accounts.

The trading process

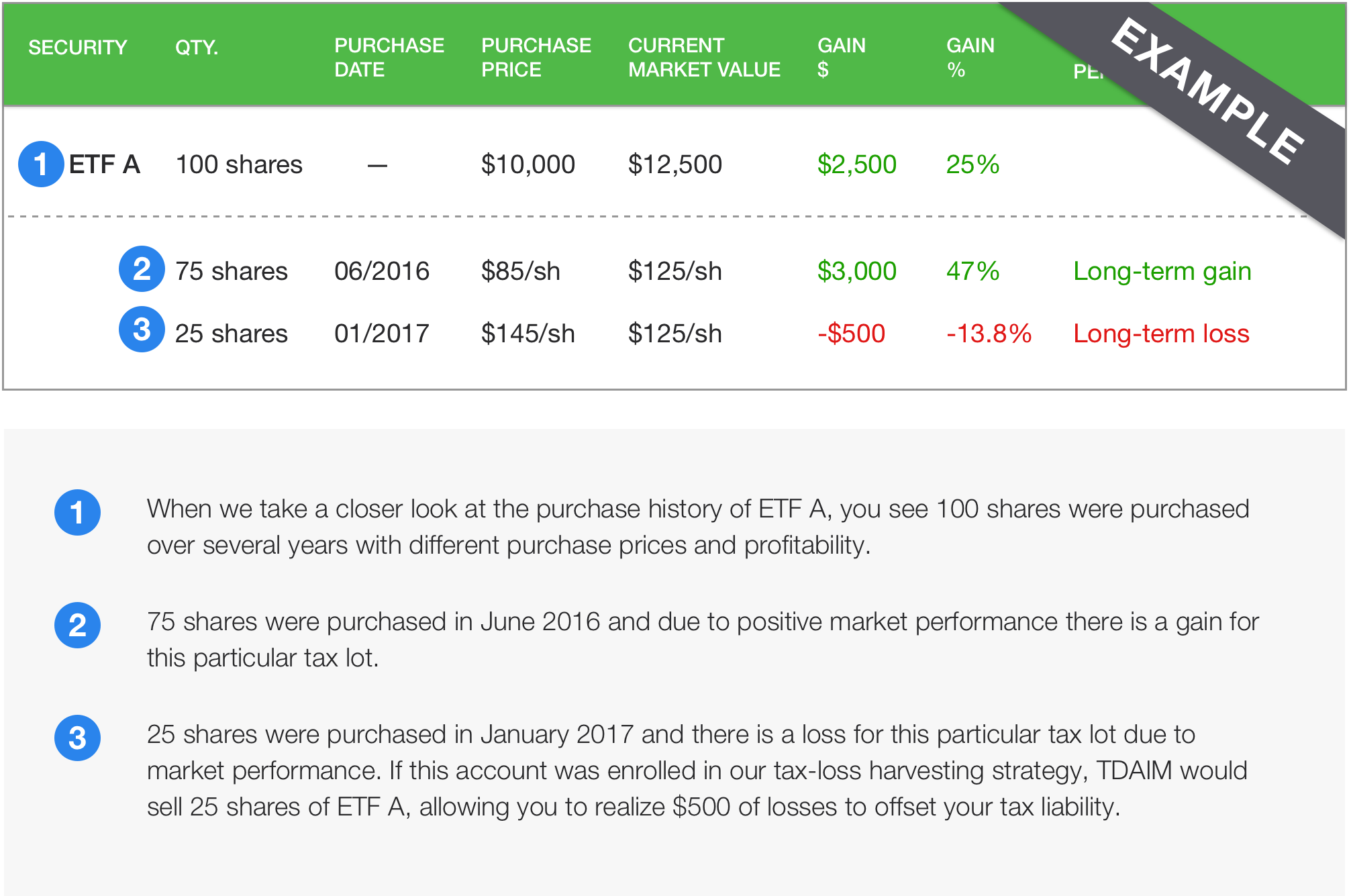

Every day, TDAIM reviews your account for individual tax lots that have lost value beyond a certain threshold. Specifically, TDAIM determines if the loss amount is significant enough before placing a tax-loss trade.

So what exactly is a tax lot? As you add money to your portfolio or as rebalances occur over a period of time, you acquire different “lots” by purchasing securities. Each acquisition or purchase of a new or existing security is considered a distinct tax lot and is eligible for harvesting.

As a part of the daily process, TDAIM may sell the investment that experienced a loss and purchase a replacement security to help maintain your asset allocation while benefiting from the potential tax savings. We do this when there is a replacement security available that fits the portfolio allocation and is itself not subject to the 30-day wash sale period.

• Your portfolio stays invested in the replacement security unless any one of the following situations occurs:

• You ask us to liquidate your entire portfolio

• You request to raise cash from your portfolio; for example, to distribute cash from your account (note: TDAIM will seek to reduce any position in a replacement security before selling any positions of primary holdings)

• The asset class the ETF represents is no longer deemed appropriate for your portfolio

• The individual replacement security no longer meets the criteria to remain in your portfolio

• A tax-loss opportunity presents itself for that particular replacement security

• You request to change to a different portfolio offered by TDAIM

• A periodic rebalance of portfolio holdings occurs

Replacement security

TDAIM applies a rigorous due-diligence process to select securities to replace those sold for tax-loss harvesting. We seek replacement securities that meet TDAIM standards, keep your portfolio in line with its target allocation, and do not put you at risk for violating the wash sale rule in your TDAIM Portfolios. We cannot guarantee that a replacement security will be available when a tax lot is sold. Some asset classes may not have as many replacement securities as others because there may not be a significant number of options available. All of the replacement securities are reviewed on an ongoing basis to choose ETFs that meet our standards, such as:

• Tracking error: We seek to invest in funds that closely track the index to which the fund is trying to provide exposure

• Daily trading volume: We seek to invest in funds that offer high levels of liquidity to investors

• Net expense ratio: We choose to invest in low-cost ETFs as much as possible

• Average 12-month premium/discount: We purchase funds that are designed to maintain a tight relationship between the fund’s net asset value and its share price

How to identify harvested losses

You can review the trading activity in your account in multiple ways. Your trading history is available to you in real-time through our online secure website and is listed on your account statements. Also, at the end of each year, TD Ameritrade provides you with IRS Form 1099 tax document, which summarizes all of the investments that were sold in a particular year as well as any dividends and interest you might have earned. You will use this form to complete your taxes each year.

If you use online tax-preparation software like TurboTax, you can easily import your transaction history when you prepare your taxes.

How to enroll

You can enroll in tax-loss harvesting online after you’re logged in to your account or by giving our team of Portfolio Specialists a call. Once enrolled, TDAIM manages the process for you, so you don’t have to. If you want to turn off the feature, you may do so at any time.

Understanding the wash sale rule

Investors should educate themselves about the IRS wash sale rule, described in IRS Publication 550. The rule prohibits you from claiming a tax loss if you repurchase the same security (or a substantially similar security) either 30 days before or 30 days after selling a security for a loss. To evaluate whether you violated the wash sale rule, the IRS reviews the trading activity for all of your accounts. In other words, the IRS looks at trades you place in other accounts at TD Ameritrade, at other brokerage firms, and in IRAs or Roth IRAs, as well as transactions your spouse made and transactions by a business entity you control to determine if you violated the wash sale rule.

For Essential and Selective Portfolios, the TDAIM tax-loss harvesting service only scans your TDAIM portfolio on an individual account level (not all of your portfolios collectively) to reduce the chance of violating the wash sale rule in that particular account. If you are invested in Personalized Portfolios as well as Essential and/or Selective Portfolios, we will take into account your tax loss harvesting activity in your Essential and/or Selective Portfolios account when considering harvesting losses in your Personalized Portfolios account. TDAIM does not have any transparency into your trading activity in your TD Ameritrade brokerage account(s) or accounts held at other financial institutions. Therefore, a trade that TDAIM places in one account may inadvertently create a wash sale in another account. You should be aware of investments in all your investment accounts to determine if you run the risk of violating the wash sale rule.

What happens if I violate the wash sale rule?

If you violate the rule, the IRS will not allow you to claim the loss for that particular transaction. Additionally, the IRS will add the loss amount to your cost basis of the new security you purchased, which will reduce your ability to claim a loss in future years. TDAIM seeks to avoid placing an individual account in a wash sale situation, which may lead to excess cash in the portfolio when a purchase might create a wash sale. This period of excess cash is monitored and resolved by reinvesting the cash after the wash sale period has ended.

Definitions

Capital Gain: when an investment is worth more now than the original purchase price (the opposite of a capital loss)

Capital Loss: when an investment is worth less now than the original purchase price (the opposite of a capital gain)

Eligible Portfolio: portfolios eligible for our tax-loss harvesting service (available only for Essential Portfolios, Socially Aware Portfolios, Selective Core ETF Portfolios, Selective Opportunistic Portfolios, or Personalized ETF Portfolios)

Realized: a capital gain or loss on a particular investment that has been closed out (i.e., sold) in a particular tax year (the opposite of an unrealized gain or loss)

Taxable Account: an account in which realized earnings, dividends, and interest are taxable each year (the opposite of a tax-deferred account, such as an IRA or 401(k) plan account)

Tax Lot: a transaction (buy or sell) in an individual security at a specific price and time

Unrealized: a capital gain or loss that is only on paper where the security has not been sold yet (the opposite of a realized gain or loss)

Wash Sale: when an investor sells an investment at a capital loss and repurchases the same security or a substantially similar one within 30 days (before or after) the original sale

Key takeaways

- Tax-loss harvesting is designed to potentially reduce your tax bill each year

- The automated tax-loss harvesting strategy is designed to help current investors offset tax consequences from successful investing

- Investing the money you save on taxes can contribute to portfolio growth

- TD Ameritrade Investment Management, LLC "TDAIM" offers current investors automated tax-loss harvesting in its ETF-based portfolios held in taxable account at no extra cost